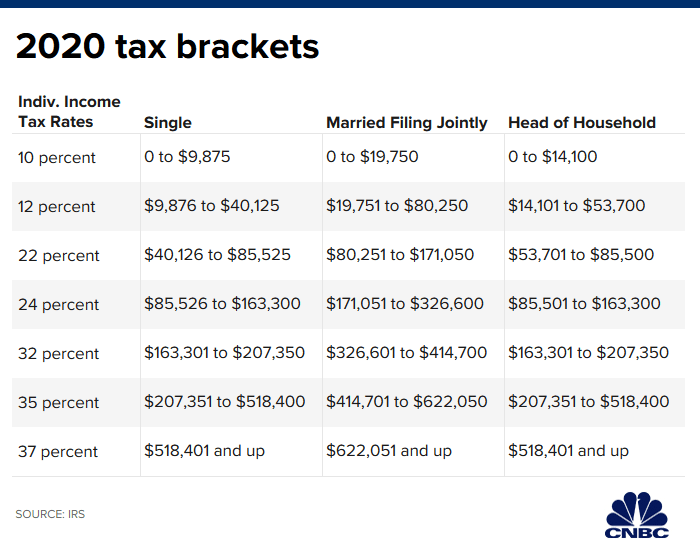

2025 Tax Brackets For Seniors. See current federal tax brackets and rates based on your income and filing status. There are seven federal income tax rates and brackets in 2025 and 2025:

Meanwhile, the lowest threshold of 10% applies to. There are seven (7) tax rates in 2025. 15% of income tax, where the total income exceeds rs.

For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint. 9, 2025 — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including the tax.

The irs has also announced new income tax brackets for tax year 2025, which will be used when filing taxes in 2025.

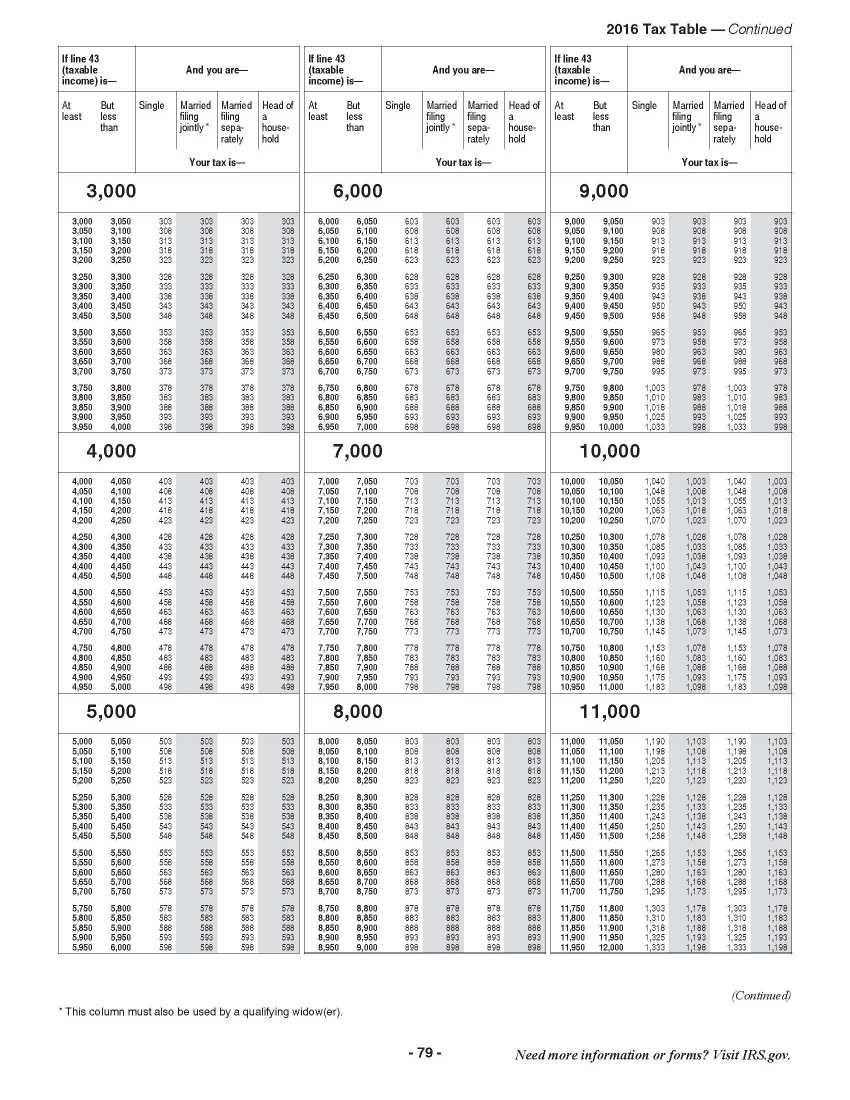

The table shows the tax brackets that affect seniors, once you include, You pay tax as a percentage of your income in layers called tax brackets.

Know the New Tax Slab Rates for FY 202324 (AY 202425, 2025 and 2025 federal income tax brackets.

IRS EZ Tax Table 2025 2025 EduVark, See current federal tax brackets and rates based on your income and filing status.

20222023 Tax Rates & Federal Tax Brackets Top Dollar, Your taxable income and filing status.

Tax Breaks for Seniors The Radishing Review, As per section 208, every person whose estimated tax liability for the year is ₹ 10,000 or more, shall pay his tax in advance, in the form of.

The 2025 Tax Brackets by Modern Husbands, Under this state program, seniors with a household income of $65,000 or less may be able to defer up to $7,500 in.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2025 versus 2025 tax brackets.

2025 Federal Tax Brackets And Standard Deduction Printable Form, There are seven federal income tax rates and brackets in 2025 and 2025:

2025 Federal Tax Brackets And Standard Deduction Printable Form, Seniors must begin withdrawing from 401(k) plans at 73.

You can use this form if you are age 65 or older at the end of 2025. Meanwhile, the lowest threshold of 10% applies to.

The above calculated tax for senior and super senior citizens shall be increased by health and education cess @ 4% of the income tax.