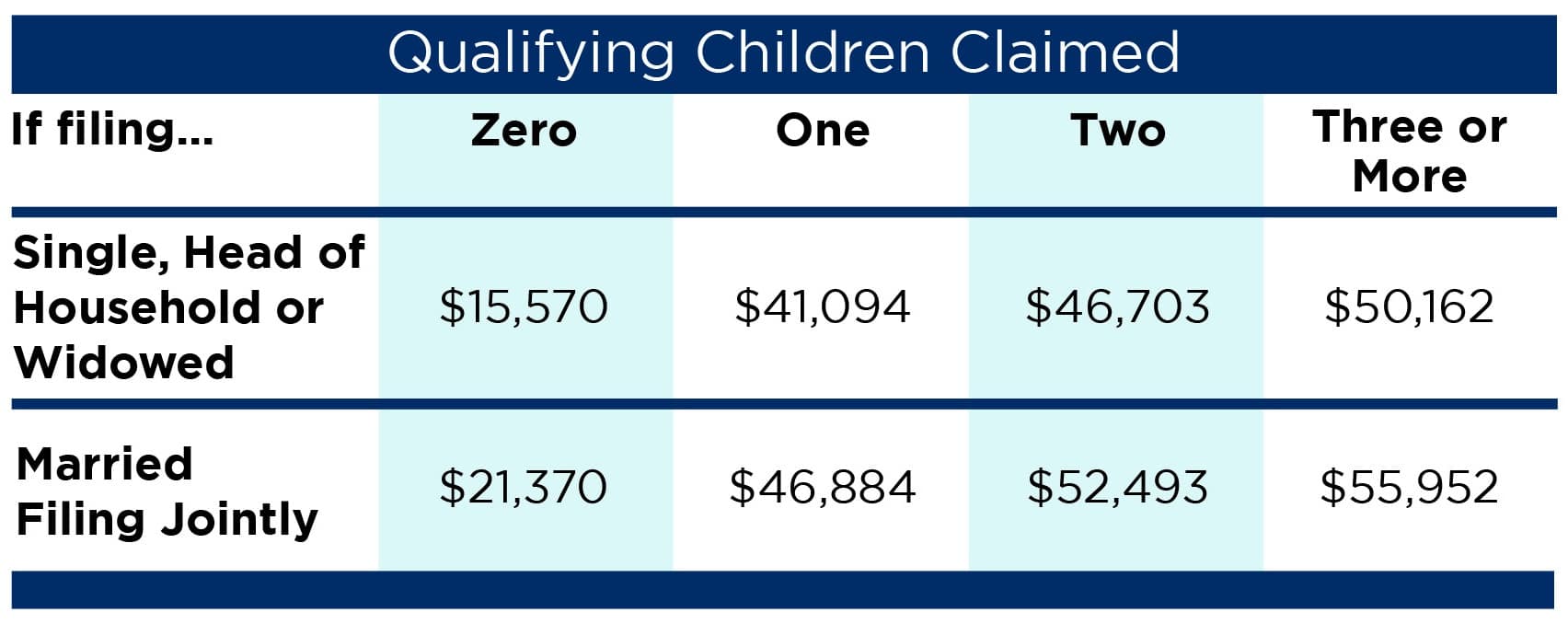

Earned Income Limit 2025. [updated with 2025 irs adjustments] below are the latest earned income tax credit (eitc) tables and income qualification thresholds adjusted for recent tax years and new legislation. Choose the financial year for which you want your taxes to be calculated.

Budget 2025 income tax expectations: For the 2025 tax year (taxes filed in 2025), the max earned income credit amounts are $632, $4,213, $6,960 and $7,830, depending on your filing status and the.

If those 31 claims weren’t enough, here’s the dispatch fact check’s analysis of five other claims about project 2025 that we’ve seen frequently this week:

Ssdi Limit 2025 Julee Maressa, That's an increase from the. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Ohp Limits 2025 Bill Marjie, For the 2025 tax year, the maximum exclusion amount under. For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000.

Ohp Limits 2025 Bill Marjie, Click here to view relevant act & rule. This amount is known as the “maximum taxable earnings” and changes each.

403b Limits 2025 Cami Marnie, This retirement planner page explains the special rule that applies to earnings for one year. A suggestion on this was put forward by banks.

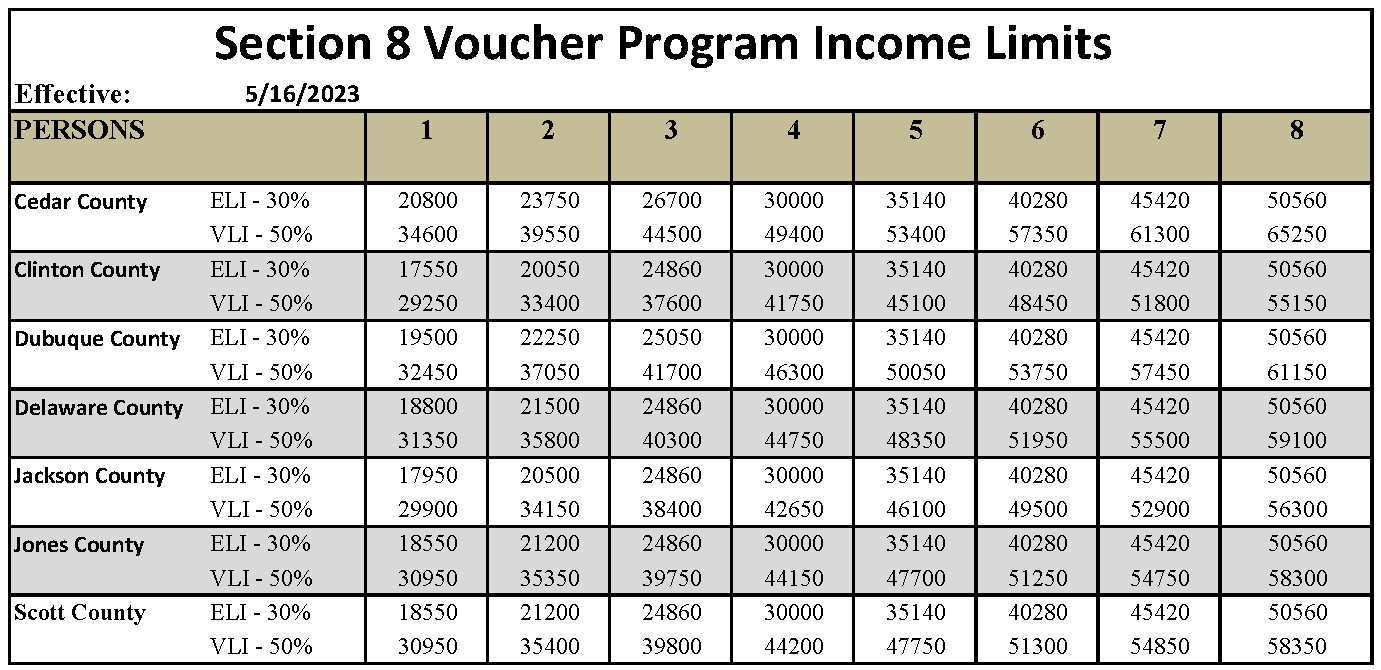

Section 8 Payment Standards 2025 Mair Angelita, The limit is $22,320 in 2025. Make informed decisions for maximum savings.

2025 Eic Chart Natka Vitoria, For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every.

Earned Credit Limitation Tax Reform Changes Ohio CPA, Following are the steps to use the tax calculator: 50% of anything you earn over the cap.

Limit For Maximum Social Security Tax 2025 Financial Samurai, For 2025, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. Expats can use the foreign earned tax exclusion (feie) to exclude foreign income from us taxation.

T200160 Distribution of Individual Tax on LongTerm Capital, In 2025, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years.

Extra Social Security Payment May 2025 Erin Odessa, If you are working, there is a limit on the amount of your earnings that is taxed by social security. This amount is known as the “maximum taxable earnings” and changes each.

For tax year 2025, the maximum foreign earned income exclusion is the lesser of the foreign income earned or $120,000 per qualifying person.