Explore ideas, tips guide and info Abbie Annette

No Tax Due Report Texas 2025. Greg abbott presented his 2025 report to the people of texas yesterday, which sets the stage for the state's. 12—austin — governor greg abbott.

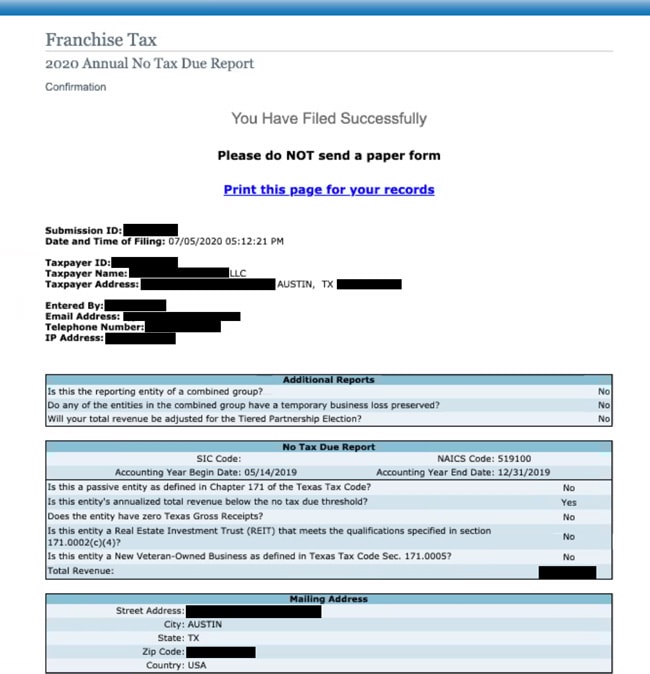

The texas comptroller of public accounts has provided notice of the discontinuation of the no tax due report for the 2025.

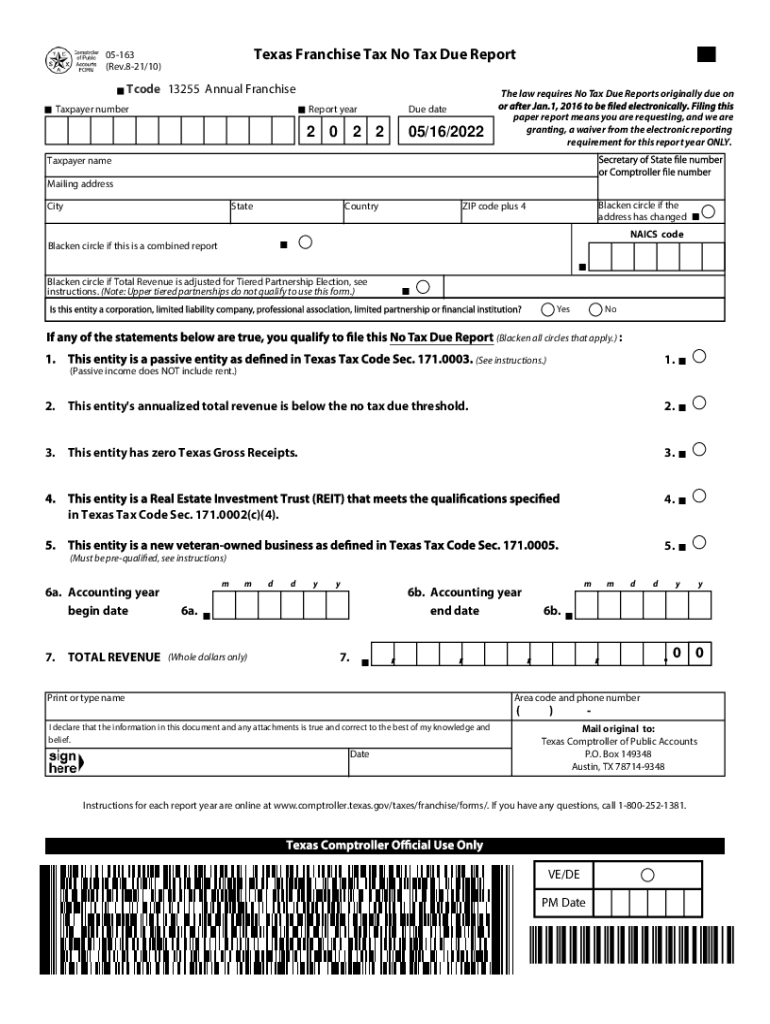

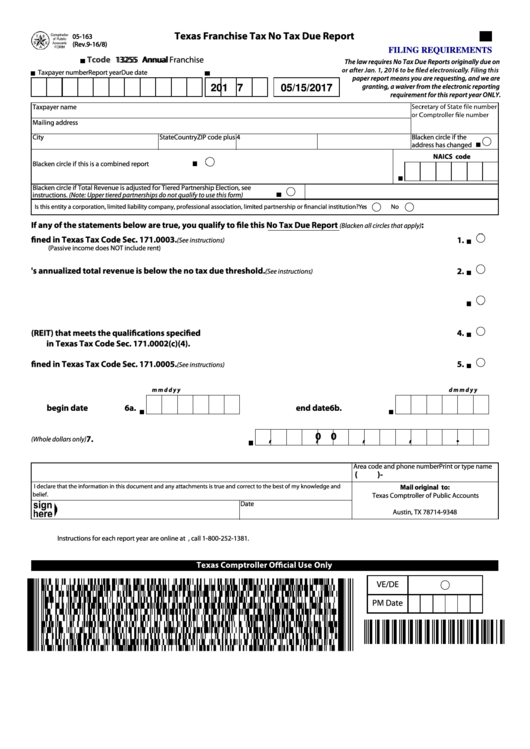

Texas Franchise Tax No Tax Due 20222024 Form Fill Out and Sign, A recent tax policy newsletter as issued by the texas comptroller of public accounts (comptroller) addresses that effective for texas franchise tax reports. Franchise tax board 2025 due date for texas.

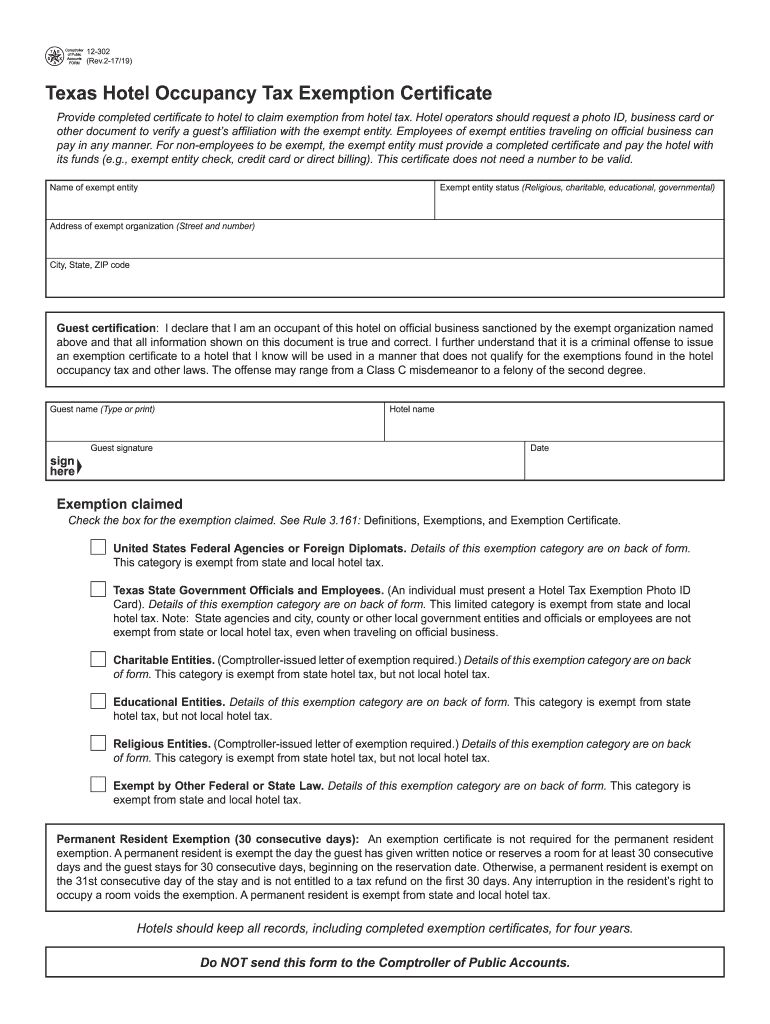

Tax exempt form texas Fill out & sign online DocHub, 1, 2025, the no tax due threshold is increased to $2.47 million doubling the amount of a taxable entity's total revenue. Greg abbott presented his 2025 report to the people of texas yesterday, which sets the stage for the state's.

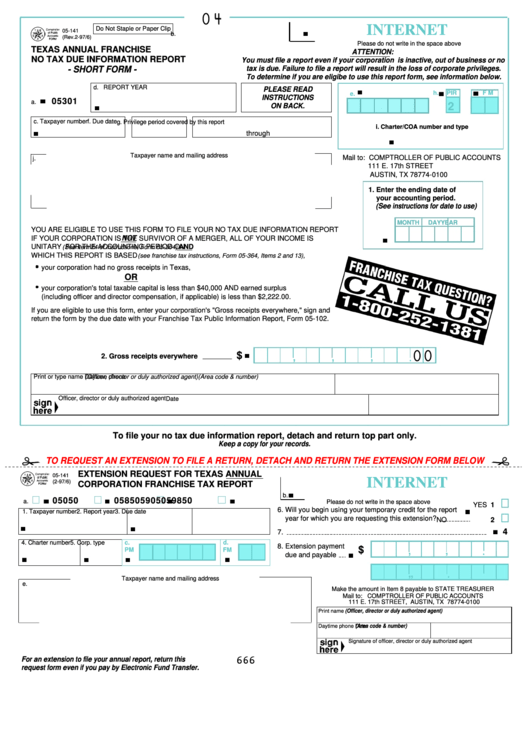

How to File Texas Franchise Tax A Complete DIY WalkThrough, No tax due threshold increases to $2,470,000 for report year 2025. Taxable entities whose annualized revenue is at or below the “no tax due’ threshold and.

How To File Texas Franchise Tax No Tax Due Report, Taxable entities whose annualized revenue is at or below the “no tax due’ threshold and. For reports originally due on or after jan.

How To File Texas Franchise Tax No Tax Due Report, Texas comptroller announces change to franchise tax filing requirement. 1, 2025, the no tax due threshold is increased to $2.47 million.

Texas LLC No Tax Due & Public Information Report LLCU®, For franchise tax reports originally due…. Effective for reports due on or after jan.1, 2025, an entity that has annualized total revenue less than or equal to the no tax due threshold of $2.47 million is not.

Fillable Texas Franchise Tax Annual No Tax Due Report printable pdf, Combined group & tiered partnership. New filing requirements for 2025.

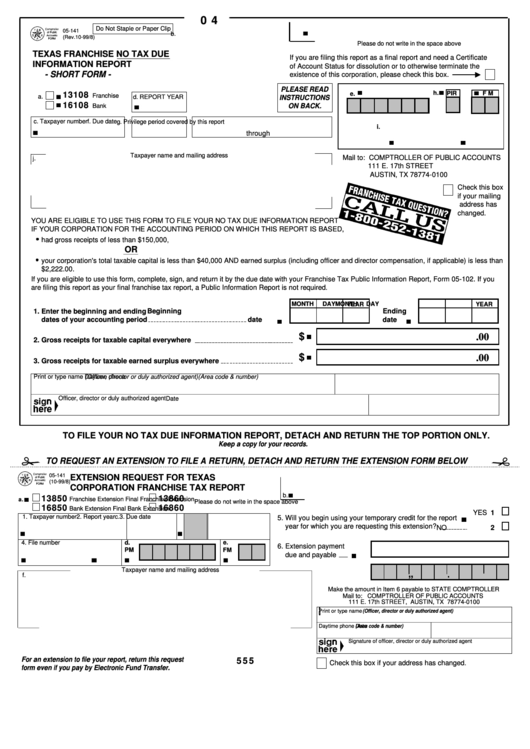

Fillable Form 05141 Texas Franchise No Tax Due Information Report, 12—austin — governor greg abbott. To be considered a qualifying new.

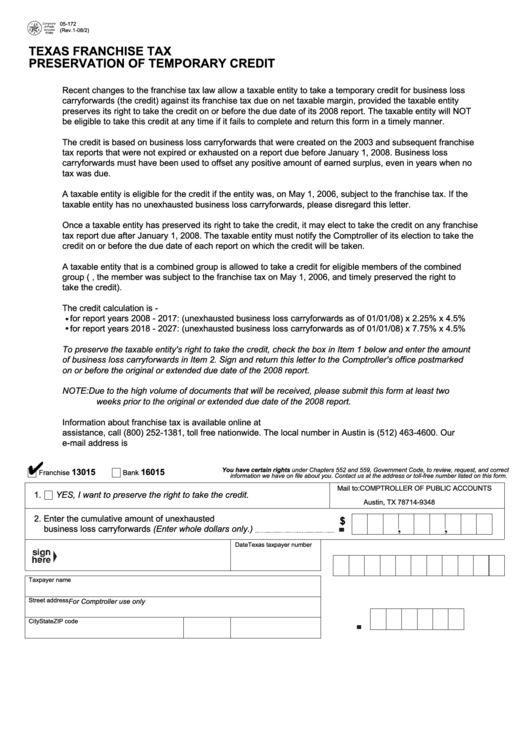

Fillable Form 05141 Texas Annual Franchise No Tax Due Information, This is a 100% increase,. A recent tax policy newsletter as issued by the texas comptroller of public accounts (comptroller) addresses that effective for texas franchise tax reports.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, How to file a no tax due report & public information report. No tax due threshold increases to $2,470,000 for report year 2025.